News & Markets

Keda Suremaker, Ma’anshan, Anhui Prov., China

Market dynamics and technological advancements in China and India

Loading...China AAC market: Market-driven capacity upgrading and technological innovation

"Dual Carbon" goals and prefabricated building policies

China's 14th Five-Year Plan explicitly states that by 2025, prefabricated buildings should account for 30% of new constructions, significantly driving demand for AAC panels. Data shows that the proportion of AAC panel production increased from 4% in 2021 to 7.3% in 2023. However, with the recent slowdown in real estate market development, this growth trend will gradually weaken.

Intelligent and large-scale production

After experiencing rapid development from 2019 to 2023, China's AAC industry has now entered a phase of extremely fierce competition. AAC enterprises with large production capacities and group-based strategies have stood out during this stage. In terms of equipment, the market increasingly demands higher production efficiency, energy-saving measures for AAC production lines, and automation to reduce labour costs.

"Six-Zero Factory" vision

This refers to the goal of achieving a modern factory with zero purchased electricity, zero fossil fuels, zero primary resources, zero carbon emissions, zero waste discharge, and zero employees. Against the backdrop of China's AAC industry pursuing high-quality development, the "Six-Zero Factory" not only represents a commitment to environmentally friendly production but also embodies corporate social responsibility. By introducing advanced production technologies and management systems, China's AAC industry is gradually moving toward this vision, striving to ensure production capacity while achieving green, safe, and sustainable development. The realization of this vision will grant Chinese AAC enterprises greater influence and competitiveness in the global market.

India AAC market: From emerging to thriving

Since its introduction to India in the 1970s, AAC has gradually gained attention, particularly after 2009, due to its high strength, excellent thermal insulation, fire resistance, sound absorption, and cost advantages. Currently, India's AAC market is experiencing rapid growth, especially under the impetus of large-scale urbanization, with production capacity increasing 25-fold over the past 15 years.

Fly ash resource utilization strategy

India's electricity supply relies heavily on thermal power, resulting in abundant fly ash resources. 95% of Indian AAC enterprises use fly ash as their primary raw material (with incorporation rates exceeding 80%), providing significant raw material cost advantages.

Favourable tax policies

According to a December 2024 report, India’s Goods and Services Tax (GST) Council clarified the tax rate for AAC blocks at its 55th meeting. Specifically, AAC blocks containing over 50% fly ash will be subject to 12% GST. Typically, AAC blocks are subject to 18% GST, while bricks or blocks containing over 90% fly ash enjoy a preferential 5% rate. This policy clarification reduces the tax burden on AAC products containing 50% fly ash, further lowering the price of these products.

Technical pathways and market challenges: Lessons learned from China and India

China: Overcapacity and high-end breakthroughs

Structural contradictions: In 2023, the industry's capacity utilization rate was only at 75%, with fierce price wars in the low-end product markets (e.g., B06-grade blocks) and small and medium-sized enterprises (SMEs) facing elimination. Meanwhile, high-end markets (e.g., composite AAC panels and low-density blocks) face supply shortages, reflecting structural imbalances in the industry. SMEs, lacking technological innovation and financial strength, tend to be limited to low-end production lines, intensifying low-end market competition. High-end markets, with higher technical barriers and fewer participants, offer greater profit margins. This structural contradiction not only hinders industry development but also exacerbates the survival challenges for SMEs.

Breakthrough directions: The emergence of large capacity, so-called "super factories," the gradual application of AAC steam heat management systems and continuous exploration of solid waste utilization have become key pathways for the industry to overcome existing challenges.

India: Localized adaptation and scenario innovation

Optimization of fly ash preparation processes: Continuous optimization of fly ash preparation processes enhances product quality and performance, further strengthening market competitiveness.

The formation of local industrial chains: India has established a certain degree of local industrial chains, which, along with the equipment and technology introduced from other countries, jointly serve the Indian AAC market.

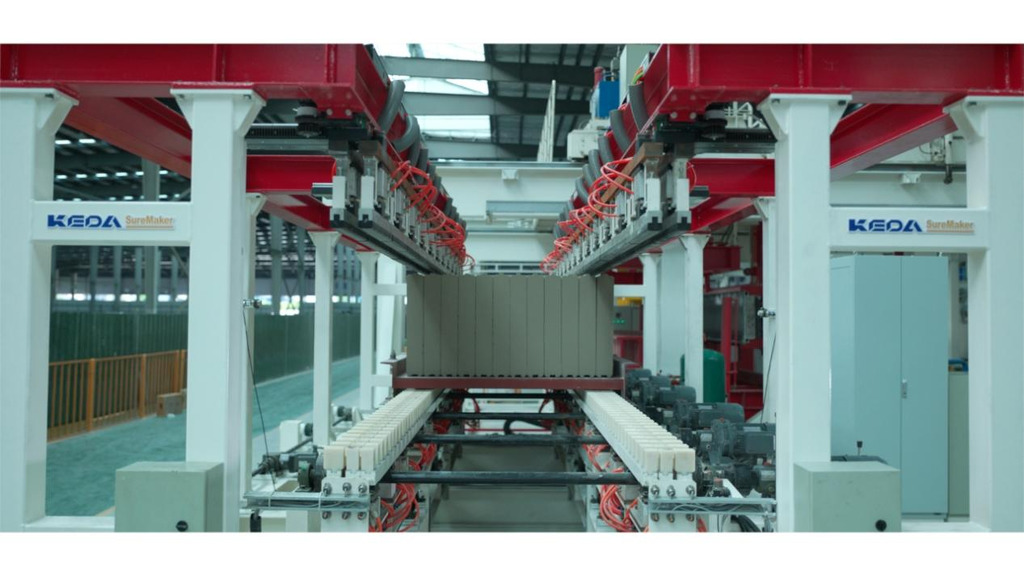

Keda Suremaker-customized AAC plant solutions: Core logic of global competitiveness

Benchmarking very large-capacity factories: As market competition intensifies, traditional small-scale production models alone can no longer meet demands for product quality, delivery timelines, and cost control. Increasingly, enterprises recognize that large-scale production is not only key to improving efficiency but also critical for reducing costs and enhancing competitiveness. Through mass production, enterprises can better withstand price pressures, meet bulk demand, and lower unit costs via economies of scale, thereby boosting overall profitability.

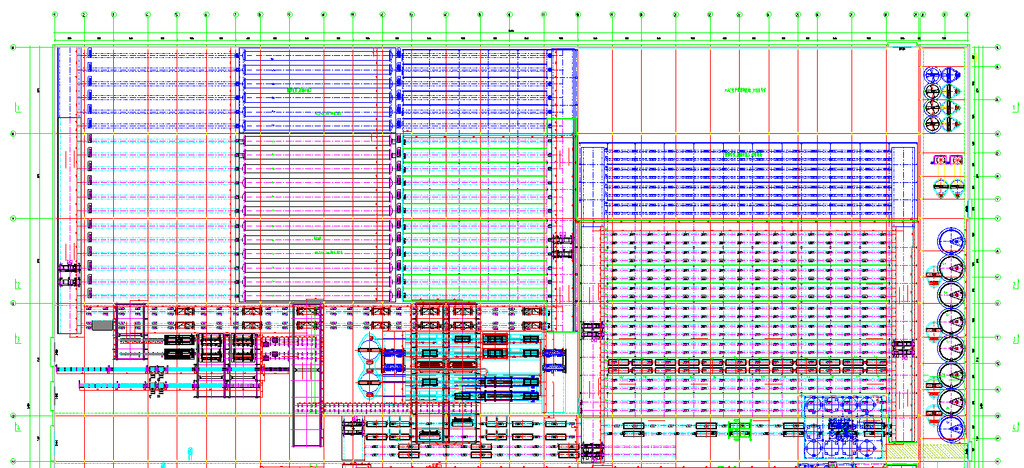

The Nantong Project with the world's largest single-line plant is under construction (single line with parallel mould circulation and double cutting line.), with a designed capacity of 2.48 million m3 of blocks or 800,000 m3 of panels annually. The following are some of the technical optimizations made by Keda Suremaker for this remarkable high-capacity AAC production line:

1. Newly designed pouring mixers with fully upgraded valve groups and pipelines, significantly improving discharge efficiency to enable high-speed production cycles for ultra-large capacities.

2. Speed-enhanced ferry carts equipped with flange wheels and self-lubricating systems for rapid maintenance.

3. Improved demoulding and walking drives with independent servo-hydraulic dual-pump controls, allowing simultaneous lifting and flipping to reduce redundant time.

4. Full servo-hydraulic system configuration enabling capacity expansion with low noise, low oil temperatures and low energy consumption.

5. Dual-station flipping machines with edge-scraping devices on small carts to shorten travel distances and save time.

6. Cutting units with automatic wire-break alarms, hydraulic chain tensioning, and automatic wire cleaning/adjustment to further enhance cutting efficiency.

This production line will be equipped with 400 molds, 18 autoclaves, 2 pouring mixers, and 2 cutting units.

Technical features and advantages:

The cutting trolley runs independently and continuously in a loop, without interference. Due to the continuous loop of the cutting trolley, there is no return stroke. The trolley's movement speed is reduced by 20 - 30% while maintaining the same cutting capacity.

It can achieve a single-cut cycle time of 90 seconds per mold, with a cutting speed that is almost the same as the traditional cutting speed.

With a dual-line layout for continuous cutting, the equipment can be used interchangeably.

Comparison of continuous cutting speed and reciprocating cutting speed:

Continuous cutting system cycle time is 90 seconds per mold, with a traveling speed of just 30 meters per minute, and a cross-cutting time of 63 seconds.

Reciprocating cutting system cycle time is 90 seconds per mold, with a loaded cutting trolley traveling speed of 50 meters per minute, and an empty trolley traveling speed of 80 meters per minute, and a cross-cutting time of 43 seconds.

International technology export: Modipur Devices Private Limited established India’s first AAC panel production line using the Hebel brand. This groundbreaking project, located in New Delhi, marks a significant milestone as India’s first AAC panel production line with green cake separation technology, powered by Keda Suremaker. To optimize the processes, Keda Suremaker developed a specialized green cake separation system to enhance production efficiency. Key features include:

1. Servo motor drives ensuring precision and smooth operation.

2. Intelligent bilateral synchronous splitting to improve efficiency.

3. Quick-switching heads adaptable to blocks and panels of varying specifications.

Flexible adaptation to different capacities: Through layout optimization, customized production lines are tailored to facilitate solid waste utilization, reduce facility and equipment investments, and shorten ROI cycles.

Future outlook

Two major trends are developing in China's AAC market. The first one is the establishment of very-large-scale intelligent production facilities. By 2030, enterprises with annual production capacities exceeding 1 million cubic meters will account for 30% of the market, integrating intelligent equipment and solid waste resources to drive the industry toward smarter, greener development. Furthermore, so-called niche market champions will be able to gain market share. Focused on innovations such as composite panels or new AAC application formats, these players will maintain stable profit margins through technological innovation and market segmentation.

India is currently experiencing a golden decade, which will bring explosive growth in demand. India's construction industry is projected to grow at an 8% CAGR, reaching $1 trillion by 2030, accounting for 13% of GDP. Residential and commercial construction in tier-2 and tier-3 cities will be key drivers, prompting enterprises to expand capacity.