News & Markets

Promising Trend

New Opportunities for the AAC Industries in North America

Loading...

Sylvester Schmidt, Civil Engineer – Dipl.-Ing. University Siegen, Germany. Sylvester held leading positions in the construction and building materials industry in Germany, France and the USA for many years. I.e. CEO of Ytong US, built and managed Ytong Florida in Haines City Florida (1996-1999) and CEO of Xella USA – rebuild and managed former Hebel plant in Adel, Georgia (2006-2009). He is a Member of ASTM and ACI, actively involved from the very start of AAC in the US, in creating Codes and Standards for AAC Blocks and Reinforced Panels for the U.S.market. Past Industry Association involvement in NRMCA – National Ready Mixed Concrete Association and NCMA National Concrete Masonry Association – Board Member 2000-2006, Chairman of the Board 2005. schmidtbps@bellsouth.net

The AAC Business in the U.S.

Two major, International AAC Companies, Ytong and Hebel, built new and then modern production facilities for AAC Blocks and Reinforced Panels in the US. Hebel in Adel, Georgia in 1995 and Ytong in Haines City, Florida in 1997. Both companies had established very successful AAC businesses for many years all over Europe and in many other countries around the world. So, it seemed obvious, that the large U.S. building market would easily accept this new building material with all it’s superior qualities in terms of thermal insulation, sound insulation, fire safety, environmental safety and durability as well as speed of construction!

Since the growing residential market in the U.S. was seemingly the best target market, both companies built their AAC production facilities with a main focus on AAC Block production. It was very difficult to break into this very conservative market that was and still is accustomed to wooden frame construction in most parts of North America. Florida may have been an exception since concrete masonry units (CMU) has become the dominant residential building material for exterior walls. The new AAC Industry realized that it was not the right target market at that time despite the superior qualities of the AAC material.

Both companies then focused on the use of Reinforced AAC Panels for the construction of Hotels, Schools, Sound Walls and Multi Family Buildings with some limited success. Even though the Owners of these Buildings and Structures praised the AAC product qualities, such as sound insulation, thermal insulation, fire safety and speed of construction as well as reduction of CO2 and other environmental qualities, these attributes were not really acknowledged by the building codes yet and marketing efforts did not carry these great messages successfully into the market.

ACCO an American AAC producer established a Panel and Block Plant with a focus on panel production, North of Orlando, Florida that was in operation from 1999 to 2005. Most of the equipment was supplied by Wehrhahn, a German AAC plant manufacturer.

The initial AAC Companies invested substantially in the development of Building Codes and Standards for the applications of AAC Masonry Units and AAC Panels in North America.

New AAC companies such as Aercon who purchased the Ytong Florida facility in 2002, as well as Hebel Mexico in Monterrey, MX – the oldest AAC manufacturer in North America – continued to develop the AAC market into the successful situation of today!

Xella North America purchased the former Hebel facility in Adel, Georgia in 2006, updated and modernized the AAC Block and Panel production – only to be caught by the major U.S. market turndown of 2008 which led to the plant closing after supplying many successful AAC panel projects in the Southeastern part of the US.

What has changed to create today’s promising situation in the U.S. for the AAC market?

It is clearly the effort of AAC producers like Aercon in Hanes City, Florida and Hebel Mexico in Monterrey, MX as well as AAC Installers like Thermacrete, LLC in Chicago and AACPS, LLC in Florida, who relentlessly promoted the superior product qualities of AAC over many years, and so many successful AAC projects were built all over the US!

Also, the change and improvement of building codes, requiring resistance to higher wind speeds due to Hurricane events, Fire Safety due to Wildfires and other Fire Events, Increase of Thermal Insulation due to higher energy cost and environmental requirements, as well as the demand for reduction of CO2 emissions, have finally created the environment where the advantages of AAC products are recognized and AAC products and systems are now used all over the US!

Angelo Coduto, Managing Director AACPS, LLC:

The opportunity for AAC has intensified and the demand has increased due to many construction market changes. The increase in cost and supply availability of conventional building materials has created an immediate demand for more AAC projects. This has been evidenced by the increase in our concurrent AAC sales as well as the numerous project inquiries for AAC products.

The versatile benefits AAC provides, has spurred our markets to grow exponentially in all regions of the USA and the Caribbean with sales in the Northwest and California to grow substantially.

Architects searching for sustainable building materials, that have the ability to resist fires and are energy efficient as well as having the ability to resist the natural perils of hurricanes and earthquakes, have begun to specify AAC products to their clients.

Developers and contractors in many of the fire affected regions in the Western and Northwestern U.S. are opting out of conventional wood products for AAC construction for cost, availability and safety reasons, per Robert Coffelt, President of Allied Masonry and Northwest AAC, Bend Oregon. His mason contracting company has been providing AAC masonry and reinforced products to the region for the past ten years and have seen a substantial increase in sales and installation projects. These areas have been affected in several areas with many large fires, the higher cost of conventional lumber materials and the availability of conventional materials have led these markets into specifying AAC. His markets include Washington, Oregon, Utah, Idaho and Northern California.

The markets are currently being seeded by two manufacturing plants that provide the full range of products including reinforced panels for walls floors and roof assemblies and all the masonry block sizes that the market requires. The plants are also providing a thin cladding panel that has helped to grow the market in the fire separation market. These thin panel products can also be used in the retrofitting of existing residential and commercial buildings that are located in the many fires prone areas of the United States.

This increase in product demand and market growth suggests that it’s time for more manufacturing plants are needed to meet these growing demands. There are several areas that would support this endeavor and reduce the cost of shipping exponentially.

With our 25 years of experience in selling and constructing AAC products to the construction markets all over the country and the Caribbean we decided that we would propose a more aggressive investment strategy that would bring multiples AAC manufacturing facilities to the United States.

The Current Market Situation

Aercon has recently updated its production facility to better meet the AAC panel production needs. The initially installed Ytong tilt cake technology was replaced by the Flat Cake Technology from Aircrete Europe, a Dutch AAC plant manufacturer, and production has recently re-started. (Note from the editor: Read a detailed report on this on pages 52 et seqq. in this issue)

A new AAC manufacturer – AAC East, LLC – recently started production of AAC Blocks and Panels in Bennettsville, SC – Wehrhahn Tilt Cake System.

The rising demand for AAC products, in particular panels has led to production impasses for the current AAC producers and additional production capacity appears to be urgently needed for the U.S. market.

Fire safety has become a priority all over the US, especially in regions, such as California, Colorado and other Western States where increased occurrences of wildfires destroyed many buildings and structures. The industry has realized that AAC Fire Wall Systems and Claddings – mainly 2”, 3” and 4” thick reinforced panels, but also Blocks – present the best building material for repairs and reconstruction.

Also, the Midwestern Part of the U.S. has embraced AAC Firewall Solutions. Especially Chicago and surrounding areas have used AAC wall panel systems very successfully for Fire Walls and Cladding already since the 1990’s. Here again, the freight costs due to the long distance to the current AAC manufacturers remain an issue.

Unfortunately, only two AAC manufacturers are currently located in the Southeast – Florida and South Carolina; and one manufacturer in Monterrey, Mexico that supplies AAC to the U.S. market. The long shipping distance to the areas where AAC products are needed is very costly and even though in many cases still cost effective, new AAC manufacturing facilities in the Western Part of the U.S. and in the Mid-West would probably be very successful in establishing a solid future AAC market!

The AAC market in the Southeast and along the U.S. East Coast, where the original AAC plants started, appears to continue the successful path of recent years, even though the market demand will probably soon surpass the manufacturing capacity of the currently two AAC plants in Haines City, Florida and in Bennettsville, South Carolina.

A Positive Outlook for AAC

As discussed above, AAC has had several chances for entry into the U.S. market, but with moderate success. The two primary reasons why a building material with vast benefits such as AAC did not proliferate into the U.S. construction market were 1) the large spread of the U.S. market, and 2) the lag of the U.S. construction industry in investing in new building materials and technologies.

Because of the larger size of the U.S.as compared to European countries, AAC would require multiple production facilities spread across the U.S.to become easily available, understood by AEC community, and hence commonly specified by engineers and architects in construction projects. The second reason that hindered the thriving of AAC is the lag of the U.S. construction industry in embracing new technologies, and for somewhat good reasons. Such reasons include the unwillingness of the construction industry to invest in new technologies because of the tight profit margins, the unwillingness to learn about new materials, the comfort of the construction industry with currently used materials, the reluctance to change the modes of operation for fear of jobsite challenges, and mostly the dominating culture that change is hard.

The authors believe that time is now most suitable to embrace AAC in the U.S. and adopt a new building material that is far more superior than those that are currently in use.

We believe the time is now ripe for a strong re-introduction of AAC to the U.S. market. For another big push to make AAC a material of choice in the US. Why? The pandemic is driving the need for greater adoption of new material technologies due to the astronomical rise in the cost of currently used materials and methods of construction. Just in 2020 and because of the pandemic, the construction industry has adopted more technology in one year than what would have normally taken several years. But the pandemic is not the only matter for driving the need for newer technologies that are more efficient and reliable. The construction industry in the U.S.is quite large, valued at $1.9 trillion in 2021 and expected to increase drastically by 2030 1. While the construction market includes five main sectors; namely, commercial, industrial, infrastructure, energy & utilities, institutional and residential, the residential construction dominates, constituting more than half of the construction industry. The project types in this sector include single-family housing and multi-family housing, which are applications most fit for AAC construction. The sector’s output over the forecast period will be supported by the government’s focus on building affordable housing units in the country. The residential construction sector has benefited from expansionary monetary policy over the past two years, when mortgage rates were pushed down to new lows, helping to drive up housing demand.

1 United States of America (USA) Construction Market Size, Trends and Forecasts by Sector – Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential Market Analysis, 2022-2026 (Pages: 59, Published: June 30, 2022 Report Code: GDCN0948MR)

The construction industry must look at new technologies to become more productive and competitive. While the construction industry has lagged in the past, there is growing interest among contractors to adopt technologies that can help them shorten schedules and use labor more efficiently address their unique risks and give them a competitive advantage in a highly competitive marketplace. And, if they adopt the right technology, construction firms will have access to more data to help them make better decisions, boost productivity, improve jobsite safety, and reduce risks.

Nevertheless, for a complete integration of AAC in the U.S. market, the AAC industry must be ready willing and able to provide the needed information, education, and learning curve for the material to flourish across the country. Not only must the AAC industry work with contractors, subcontractors, and masons for education on the use of the AAC products but should also provide adjustments to the manufacturing, design, and handling AAC that would be most fitting for the U.S. market.

The AAC System

The manufacturing process results in a complete system of basic building components, primarily comprised of the following:

Blocks (unreinforced)

Panels (steel-reinforced)

Lintels (steel-reinforced)

The block units are used in the construction of load-bearing and non load-bearing walls, whereas the panels are primarily used for roof and floor decks as well as exterior walls and interior partitions.

How AAC Works and its Benefits

AAC is a lightweight artificial stone of uniform cellular structure. The cellular structure is like that of a sponge and contains millions of air cells ranging in size between 0.1 and 1.0 mm. It is due to that structure that the material achieves its lightweight and all the concomitant high-performance qualities. The pore structure of AAC has a direct effect on all physical properties of the material. Pores present in AAC can be divided according to size into micropores (< 1 mm) and macropores (0.1 to 1.0 mm), or what is referred to as structural pores and artificial pores respectively. Of the total porosity or pore volume, approximately 35 percent are micropores and the remainder 65 percent is macropores

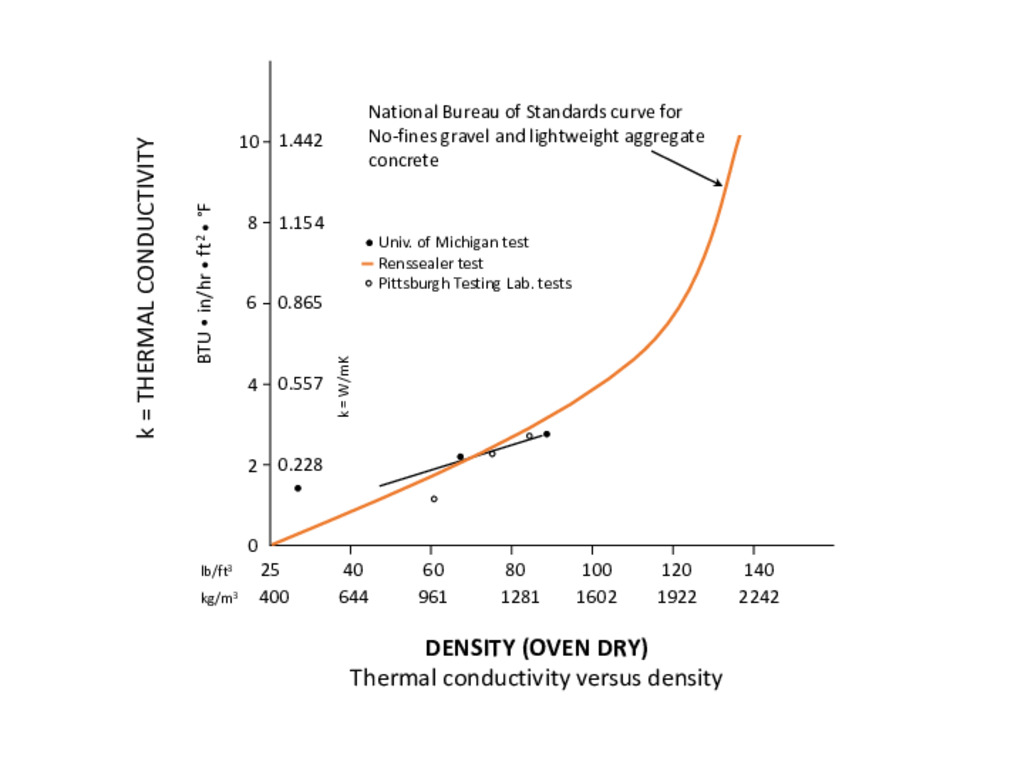

As shown in fig. 1, AAC is about 10 times better than ordinary dense concrete with respect to heat conductivity and that is solely due to the pore structure of the material. As a result, the beneficial properties of AAC with regards to heat conductivity, thermal insulation, thermal inertia, fire resistance, freeze and thaw, and sound isolation are established.

No building material possess all these benefits while being ultra-lightweight resulting in larger size of units that can be more economically transported and erected. Construction time is further minimized due to the ease of cutting and shaping the material in the field. Although special equipment is needed for handling the reinforced panels, these are simple inexpensive lifting devices that do not represent a major capital expense. Furthermore, the material is highly workable as it can be sawn, nailed, and drilled similar to wood using hand tools.

In summary, AAC has characteristics that make it well suited for the U.S. market and its constant quest for energy savings, durability, and speed in construction. The benefits of using AAC are numerous making it a clear choice for residential and commercial construction.

Technical and Design Information

Materials and structural research activities on AAC began in the U.S. in the late 1980s on imported AAC blocks and panels. However, once manufacturing plants were established in the late 1990s, it was evident that additional research on U.S.-manufactured AAC was needed. In depth research was conducted at both University of Alabama at Birmingham and the University of Texas at Austin focusing on the material properties of AAC and the structural behavior of steel reinforced AAC elements. These research studies formed the basis for the development of ASTM standards and ACI technical committee reports.

Around the turn of the 21st century, professional organizations in the U.S. through technical committee work provided the platform for the development of technical design information tailored to the production of AAC in the U.S. The American Concrete Institute (ACI), the American Society for Testing and Materials (ASTM), and The Masonry Society (TMS) took the lead in developing technical information in the form of standards and design guides for AAC.

ACI Committee 523 led the development of technical information and guides on the structural design and detailing of AAC reinforced panels. ASTM produced four standards for the specification, testing, and use of AAC unreinforced and reinforced elements. Non reinforced AAC masonry was addressed by TMS. ACI Subcommittee 523A was formed in 1997 as part of ACI Committee 523 “Cellular Concrete” to focus on AAC. The subcommittee worked diligently on a design guide for AAC. The guide was approved by Committee 523 and published in 2009 [ACI 523.4R-09, Guide for Design and Construction with Autoclaved Aerated Concrete Panels].

A recent publication by Fudge, Fouad, and Klingner (2019) delineates in detail the background for the structural design developments in the U.S.

Sustainability of AAC

AAC is an exemplary construction material since it is produced from natural materials that are readily available. Because of its light weight, AAC has a clear advantage in transportation energy in comparison to denser materials such as concrete or masonry. AAC waste during construction is minimal since pieces can be cut to exact dimensions using standard wood cutting tools. AAC is a highly durable material and can be easily recycled after disposal. Because it is made with inert materials, AAC does not adversely affect indoor air quality. Most important are the energy savings due to the remarkable thermal properties of the material.

Furthermore, the production of AAC demands relatively small amounts of raw materials per cubic meter of product, and up to a fifth as much as other concrete construction products. Its high resource efficiency results into a low environmental impact in all phases of its life cycle. And very importantly: AAC is fully recyclable.

The manufacture of AAC requires less energy than for all other masonry products, thereby reducing use of fossil fuels and associated emissions of carbon dioxide. Industrial-quality water is used and neither water nor steam are released into the environment. No toxic gases are created in the production process.

Conclusion

It is expected that the usage of AAC will proliferate as more production plants are constructed and as the knowledge and familiarity with the material increase. The material has a proven track record and wealth of information is available in the domestic and foreign literature to provide the specifier and user with a reasonable level of confidence.

Technology is set to change the construction industry. New and emerging technologies are showing potential to reduce risk, improve productivity, and increase profitability on construction projects. Considering the outstanding characteristics of AAC combined with the positive outlook for the construction industry, it is highly likely that AAC will make a comeback into the U.S. market. However, to ensure success, the AAC system must adapt to the U.S. market needs.

It is inevitable that AAC will gain a rapid acceptance as a new building product in the U.S. due to the increasing importance placed on the conservation of energy (both the energy savings produced by thermal insulation and the amount of energy required for the mass production of the product). The rising cost of lumber and increasing environmental concerns will also play a role in the increasing interest in AAC. The availability of technical design information and standards for AAC will serve as a tool to further promote and expand the use of the material.

All in All, it looks like a very positive outlook for the AAC industry in the USA!

Visit World of Concrete, January 16th to the 19th, in Las Vegas to meet international suppliers to the autoclaved aerated concrete industry in the All New AAC Pavilion. Want to learn more? AAC-lectures from world renown experts will be held on the 19th of January at the Las Vegas Convention Center.